Facebook Marketplace may seem like the best place to find a deal, but it comes with the risk of being scammed by fraudsters with fake checks. To avoid falling for fake cashier’s checks when selling items on Facebook Marketplace, it’s best to only accept payment via other methods, such as cash or PayPal. If you do want to accept cashier’s checks, be on the lookout for red flags of scams.

“Red flags” are warning signs or indicators that suggest potential problems, concerns, or issues. In various contexts, red flags serve as signals that prompt individuals to exercise caution, conduct further investigation, or reconsider a situation.

参考释义:”示警红旗” 是指示潜在问题、关切或困难的警示标志或指标。在不同的背景下,红旗充当信号,促使个人谨慎行事、进行进一步调查或重新考虑情况。

What Are Facebook Marketplace Fake Cashier’s Check Scams?

There are a couple of ways people can scam you on Facebook Marketplace using counterfeit cashier’s checks:

- They send you a fake cashier’s check for more than the cost of an item and then ask for a refund of the excess amount.

- They send you a fake cashier’s check for the exact amount, which ends up bouncing.

Here’s how these Facebook Marketplace fake cashier’s check scams work.

The Buyer Asks to Pay with a Cashier’s Check

Typically, accepting a cashier’s check seems like a relatively safe way of getting paid because an honest buyer would go and pay for the check with cash to get it. However, with a fake cashier’s check, the buyer produces a worthless check.

Scammers will insist on paying by cashier’s check only. Even if you tell them you don’t accept cashier’s checks, they will insist and will have any number of excuses as to why that’s their only payment option.

Example Message from ScammerPlease, I know you said you only accept PayPal, but I can’t access my account right now (long story) so need to pay using cashier’s check. I can go get the cashier’s check today and send it to you so you will have the money fast. You can send the item to me once you receive the check, no worries.

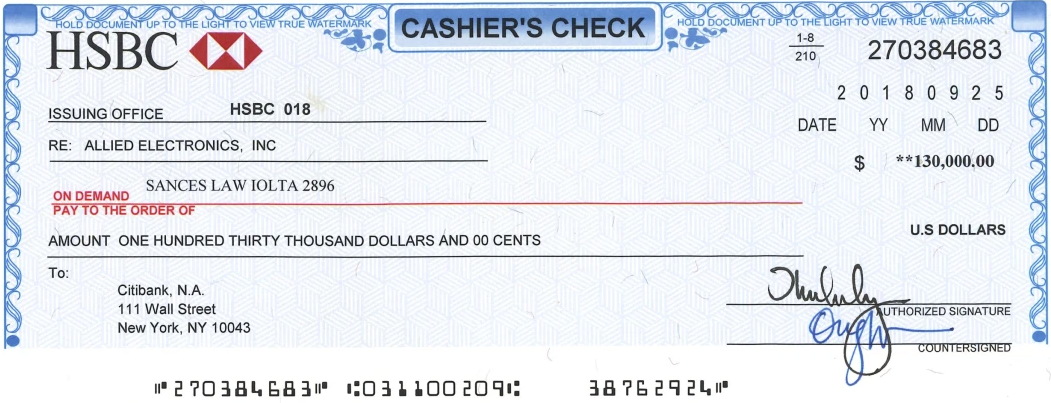

You Receive a Fake Cashier’s Check

You receive a cashier’s check that looks real, so you deposit it. The bank releases the funds into your bank account, so you hand over the item to the buyer (i.e., the scammer).

In some cases, the buyer will have written you a check for more than the item’s sale price. They’ll tell you it was a mistake and ask you to wire back the difference, which you do.

The Check Bounces

A few days after you deposit the check and give the item to the buyer and/or transferred money to them (to make up the difference), you find out that the check has bounced.

“Check has bounced” means that a check that was presented for payment was not honored by the bank due to insufficient funds in the account. When a check bounces, it indicates that the account holder does not have enough money to cover the amount specified on the check.

“支票被拒付” 意味着被提供付款的支票由于账户资金不足而未被银行承兑。当支票被拒付时,表明账户持有人没有足够的资金来支付支票上指定的金额。

The bank reverses the funds initially released to your account since the cashier’s check was a fake.

You’re Unable to Get Your Money and Item Back

After giving the item and/or money to the buyer, it will be impossible to contact them. They are deliberately trying to avoid you at this point because they know the cashier’s check will be denied.

You won’t be able to get your item back, and it’ll be too late to reverse the wire transfer for any money you sent them.

Red Flags of Fake Cashier’s Check Scams on Facebook

There are plenty of resources online that allow scammers to easily create counterfeit cashier’s checks online. It’s a good idea to learn how to spot a fake cashier’s check by understanding some of the most common red flags to watch out for. These include:

- Buyers who insist on paying with cashier’s checks or are very pushy.

- Checks that are written for more than the value of the item you listed.

- Fake checks often include more than the agreed upon amount in order to coax the seller into sending back the overpaid funds to the scammer.

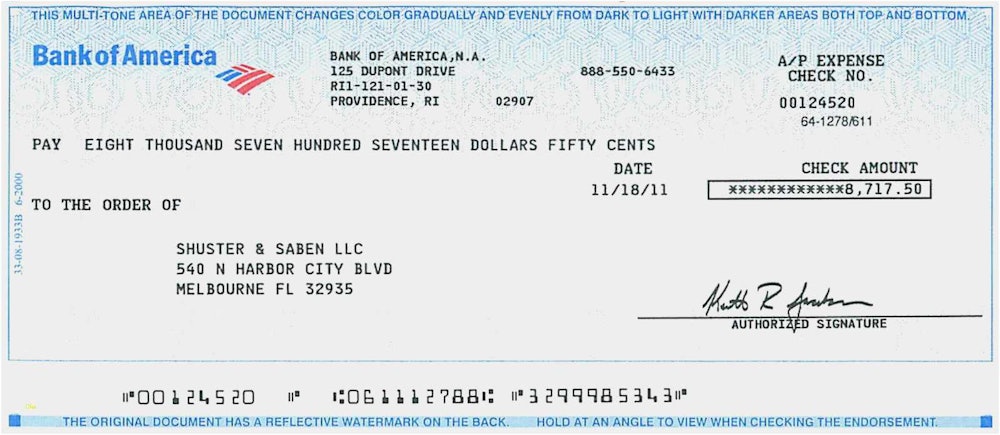

- Incorrect routing numbers.

- A quick Google search reveals that no Bank of America branch has a routing number of “00124520.”

- A local buyer refusing to allow you to accompany them to the bank as they get the cashier’s check.

Signs of a fraudulent check include misspelled words, odd spacing, missing security features, or low-quality paper.

How to Beat Fake Cashier’s Check Scams on Facebook Marketplace

To beat this scam, you should not accept cashier’s checks to pay for items and instead only take other forms of payment such as:

“Pending” Transactions Are Not Approved

Although the bank may have released funds into your account, the check itself will show as “Pending” (or something similar) on your bank statement. Don’t send any items or money to the buyer until the check is fully processed and is no longer pending (it can take several days).

If you do accept a cashier’s check, only send the product (or money for overpaid amounts) once the check has fully cleared. If the buyer is local, you can also ask to go with them to the bank to get the cashier’s check.

You can also use this safety checklist before accepting any check to ensure its legitimacy:

- Use the FDIC’s Bank Find system to check that the bank is:

- Real and an FDIC-insured banking institution in the U.S.

- Call the bank with the number you found on the FDIC’s website or the bank’s official website, don’t use the number on the check.

- Ask them to verify the check on the spot by giving them the check number, issuance date, and amount.

- Carefully review the potential buyer’s communications.

- Scammers often communicate only via email, text or Facebook messenger and may contain poor grammar and spelling mistakes.

- Verify the check’s address.

- If the postmark doesn’t match the city and state of the “supposed” issuing bank (or it has an overseas address), it might be a fake check.

- Ensure the amount is correct and not an overpayment.

- Check for official markings of checks such as:

- Watermarks

- Security threads

- Color-changing ink

What to Do if You Receive a Fake Cashier’s Check

If you’ve fallen for a Facebook fake cashier’s check scam, you can try to get your item and money back by:

- Contacting the postal service you used to send the item and rerouting the delivery if it is still en route.

- Request a reversal of any money you sent via wire transfer:

- Contact Western Union at (800) 325-6000.

- Contact MoneyGram at (800) 666-3947.

You’ll only be able to recoup your losses if you act quickly. Unfortunately, once the item has been delivered, there’s nothing USPS, UPS, FedEx, or other delivery services can do to get your item back.

If you sent money via wire transfer, you wouldn’t be able to get your money back if the money has already been claimed by the scammer or deposited into their account.

Report the Scam

You should report Facebook fake cashier’s check scams to Facebook and the authorities, such as the Federal Trade Commission (FTC).

- The Federal Trade Commission.

- The U.S. Postal Inspection Service if you received the check by mail.

- Your state or local consumer protection agencies.

- File an online complaint with the Internet Crime Complaint Center.

Although it won’t help you get your item and/or money back, reporting it will help stop others from falling for it in the future.

——>> 推荐阅读:Beware of Cashier’s Check Scams – my own recent experience